These days we are constantly bombarded with advertisements related to mutual funds. The ongoing campaign “Mutual Fund Sahi Hai!!” is meant to attract the retail investors to invest in markets. India is one of the few countries in the world where retail participation in equity markets is less than 5%. There are many shows running on business news channels recommending that we can start a SIP at any time, no matter what the market scenario is.

But recently, due to corona-virus markets has suffered a huge downfall. Whatever gains nifty made in 4 years are lost in just 2 weeks. This means those who started their SIPs, 4 years back are now suffering from huge losses while conservative investors who invest via recurring deposits are enjoying positive returns.

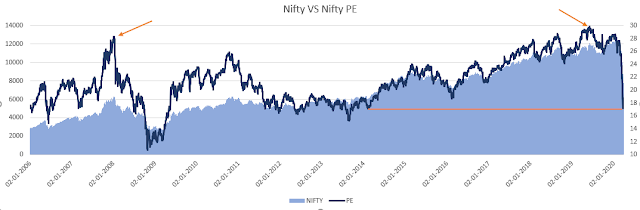

While investing in stocks, we generally check the PE ratio (Amount paid for 1 unit of earnings). I believe same applies to index also but still we ignore it. Nifty’s PE ratio has never crossed 30 and before recent crash it was close to 30. Same was the scenario during 2008 financial crises.

In October 2017, NIFTY’s PE crossed 25 when it breached 10000 mark. Within 26 months in January 2020, it breached 12350 mark (PE 28.6) providing an annual return of 10.84%. Risk adjusted return (Sharpe Ratio) comes out to be 0.31 i.e. we earn 0.31 units of extra return for every unit of risk. (Note: Fixed deposit rate of 6.5% is considered as risk free rate).

In April 2014, Nifty’s PE was 17 and trading at level of 6000. If we assume that a person invested till PE crossed 25 i.e. 10000 mark (October 2017). Annual return stood at 18.18% and Sharpe ratio comes out to be 0.76. (Note: Fixed deposit rate of 7.5% is considered as risk free rate).

Conclusion: Every time is not the right time to invest in Mutual funds. It is important to look at valuations and historic data before starting a long-term investment in the market. If valuations look costly then it’s better to invest less and accumulate more cash so that next time when market is down, we have sufficient funds to invest.

Comments

Post a Comment

If you have any doubts or want more clarity on a particular topic, please let us know.